The goal of Thailand's development toward the "Thailand 4.0" era has led to the Eastern Economic Corridor (EEC) project in three provinces: Rayong, Chonburi, and Chachoengsao. It is a major transformation of the Eastern Seaboard changing it from an agricultural society to an industrial region, a large investment area under eight development plans:

1. Base Area Structure Development Action Plan;

2. Targeted Industry Development Action Plan;

3. Human Resource Development, Education, Research, and Technology Action Plan;

4. Tourism Development and Promotion Action Plan;

5. New Urban and Community Development Action Plan;

6. Business Center and Financial Center Development Action Plan;

7. Action Plan for Public Relations and Process for the Public’s Participation in the Project;

8. Agriculture, Irrigation and Environment Action Plan.

At the same time, several targeted industries are being promoted in order to create concrete investments and develop economic activities that will expand in the future.

Target industries in the EEC include the following:

1. Modern automotive industry

2. Food processing industry

3. Aviation and logistics industry

4. Digital industry

5. Smart electronics industry

6. High-income group tourism and wellness tourism

7. Comprehensive medical industry

8. Defense industry

9. Agriculture and biotechnology

10. Robotics industry

11. Biofuel and biochemical industry

12. Personnel development and education industry.

Between 2023 and 2027, the government is allocating a budget of 337 billion baht for the development of 77 infrastructure and public utilities to create a seamless road, water, and air transportation network that will turn the EEC into the economic center of Thailand-ASEAN in the future, create another 100,000 jobs in 5 years, and reduce logistics costs by 16%. The "special targeted industries" in the EEC, in the First and New “S-Curve,” are as follows:

- Expansion from the original industries to create added value (First S-Curve), divided into 5 industries:

(1) Modern automotive industry;

(2) Smart electronics industry;

(3) High-income tourism/ wellness tourism industry;

(4) Agricultural industry and biotechnology;

(5) Food processing industry.

- Five future industries to raise the value of industries (New S-Curve):

(1) Robotics industry;

(2) Aviation and logistics industry;

(3) Biofuel and biochemical industry;

(4) Digital Industry;

(5) Comprehensive medical industry.

- Two special industries:

(1) Defense industry;

(2) Personnel development and education industry.

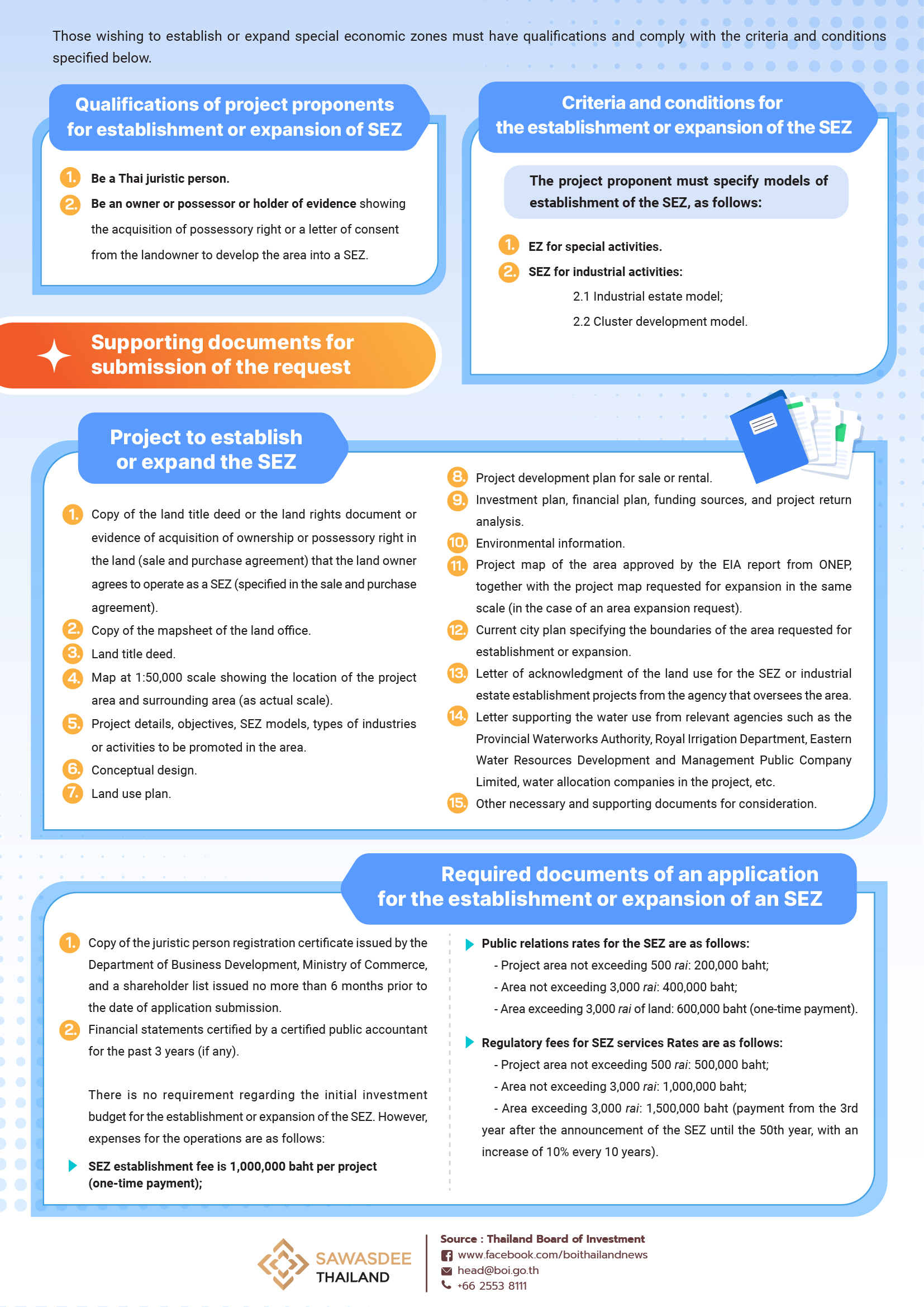

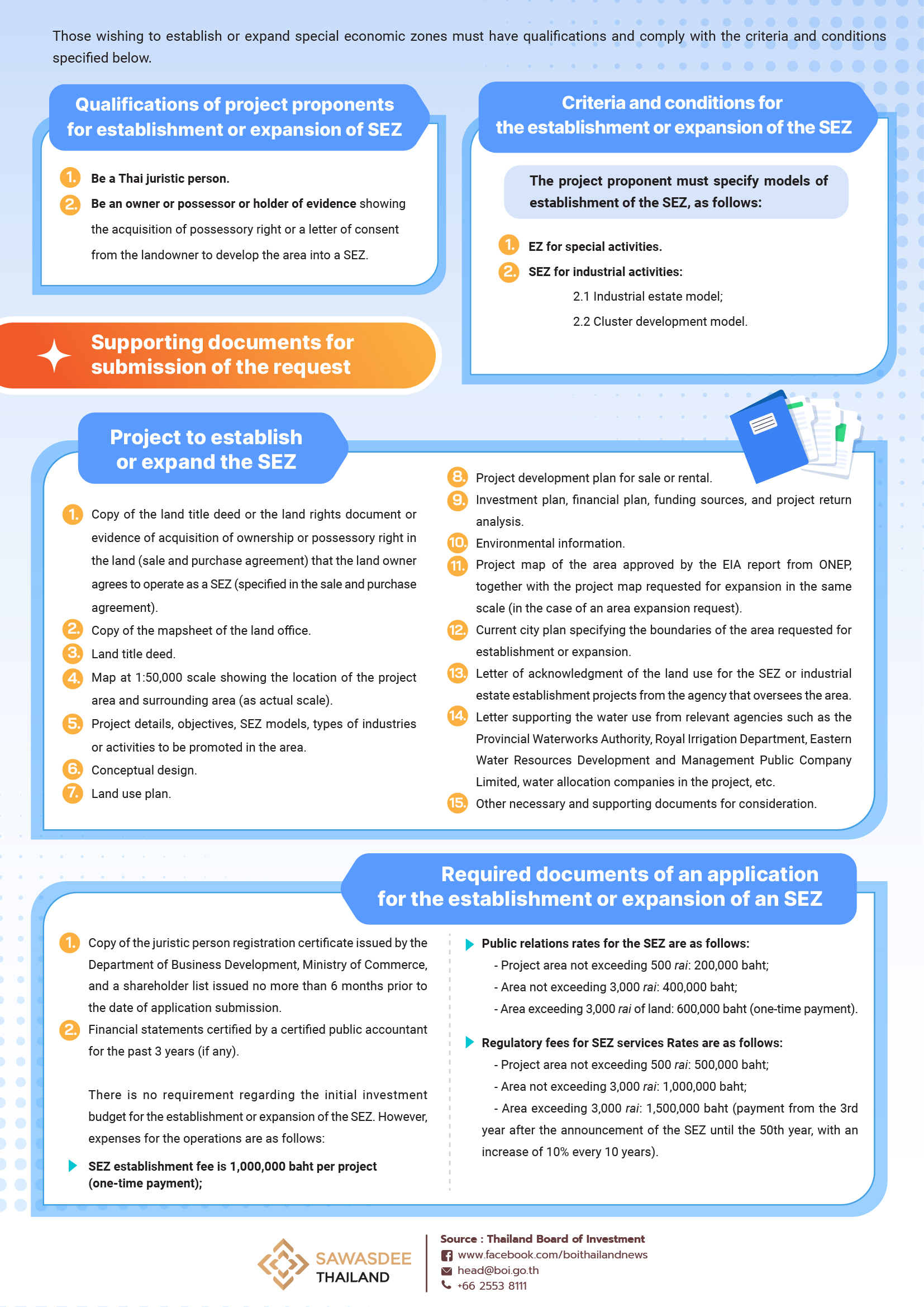

Those wishing to establish or expand special economic zones must have qualifications and comply with the criteria and conditions specified below.

- Qualifications of project proponents for establishment or expansion of SEZ

1. Be a Thai juristic person;.

2. Be an owner or possessor or holder of evidence showing the acquisition of possessory right or a letter of consent from the landowner to develop the area into a SEZ.

- Criteria and conditions for the establishment or expansion of the SEZ: The project proponent must specify the model for establishment of the SEZ as follows:

1. SEZ for special activities;

2. SEZ for industrial activities:

2.1 Industrial estate model;

2.2 Cluster development model.

- Submission of the request and supporting documents are as follows:

Project to establish or expand the SEZ

1. Copy of the land title deed or the land rights document or evidence of acquisition of ownership or possessory right in the land (sale and purchase agreement) that the land owner agrees to operate as an SEZ (specified in the sale and purchase agreement);

2. Copy of the mapsheet of the land office;

3. Land title deed;

4. Scale map of 1:50,000 showing the location of the project area and surrounding area (as actual scale);

5. Project details, objectives, SEZ models, types of industries or activities to be promoted in the area;

6. Conceptual design;

7. Land use plan;

8. Project development plan for sale or rental;

9. Investment plan, financial plan, funding sources, and project return analysis;

10. Environmental information;

11. Project map of the area approved by the EIA report from ONEP, together with the project map requested for expansion in the same scale (in the case of an area expansion request);

12. Current city plan specifying the boundaries of the area requested for establishment or expansion;

13. Letter of acknowledgment of the land use for the SEZ or industrial estate establishment projects from the agency that oversees the area;

14. Letter supporting the water use from relevant agencies, such as the Provincial Waterworks Authority, Royal Irrigation Department, Eastern Water Resources Development and Management Public Company Limited, water allocation companies in the project, etc.;

15. Other necessary and supporting documents for consideration.

- Required documents from an applicant for the establishment or expansion of the SEZ are as follows:

1. Copy of the juristic person registration certificate issued by the Department of Business Development, Ministry of Commerce, and a shareholder list issued no more than 6 months prior to the date of application submission;

2. Financial statements certified by a certified public accountant for the past 3 years (if any).

There is no requirement regarding the initial investment budget for the establishment or expansion of the SEZ. However, expenses for the operations are as follows:

- SEZ establishment fee is 1,000,000 baht per project (one-time payment);

- Public relations rates for the SEZ are as follows:

- Project area not exceeding 500 rai: 200,000 baht;

- Area not exceeding 3,000 rai: 400,000 baht;

- Area exceeding 3,000 rai of land: 600,000 baht (one-time payment).

- Regulatory fees for SEZ services. Rates are as follows:

- Project area not exceeding 500 rai: 500,000 baht;

- Area not exceeding 3,000 rai: 1,000,000 baht;

- Area exceeding 3,000 rai: 1,500,000 baht (payment from the 3rd year after the announcement of the SEZ until the 50th year, with an increase of 10% every 10 years).

Investment privileges in the SEZ

1) Tax privileges under the Investment Promotion Act

- Corporate income tax exemption for certain activities for up to 13 years:

- Group A1+: additional 2-year corporate income tax exemption (with R&D HRD)

- Group A1-A4: 50% reduction of corporate income tax for an additional 3 years (with R&D HRD);

- Group A1+: additional 1-year corporate income tax exemption;

- Group A1-A4: 50% corporate income tax reduction for an additional 2 years;

- Import duty on machinery exemption;

- Duty exemption on imported raw materials for export production and research and development;

- Funds to support the development of targeted technologies according to the Competitiveness Enhancement Act.

2) Tax privileges under the Ministry of Finance’s Notification

- 17% personal income tax rate for foreign professionals working in the SEZ; 15% personal income tax rate for foreign executives working, with the establishment of a head office or international trade office in the EEC;

- Entitlement to deduction of expenses from investment, research, development, and innovation up to 300%. Projects are certified by NSTDA.

3) Privileges for the SEZ

Ownership of land/ condominium/ lease period

- Foreign juristic persons may hold land ownership to operate business in the SEZ;

- Foreign juristic persons may own condominiums to operate business and residence in the SEZ;

- Lease or sublease agreement of land or real estate in the SEZ for not more than 50 years and renewal for not more than 49 years.

Import of foreigners into and staying in the Kingdom

Immigration rights: Experts, executives, or professionals and their spouses and dependents are allowed to stay in Thailand for a maximum of 4 years.

Financial transaction

- Exemption from the law governing foreign exchange control and use of foreign currency in the SEZ.

Other benefits

- Entitlement to the same benefits as entrepreneurs in free zones bonded warehouse or free trade zone;

Professional practitioners or applicants for permission are licensed, registered, or certified to practice professionally for business in the SEZ.

4) One Stop Service Center

To facilitate investment approval Legally permitted are as follows:

- Land Excavation and Law Filling Act;

- Building Control Act;

- Machinery Registration Act;

- Public Health Act;

- Immigration Act;

- Commercial Registration Act;

- Factory Act;

- Land Allocation Act.

Contact: Office of the Eastern Economic Corridor Policy Committee (EEC), 25th floor, CAT Telecom Building, 72 Soi Wat Muang Khae, Charoen Krung Road, Bang Rak Subdistrict, Bang Rak District, Bangkok

Telephone : +66 2033 8000

Online contact channel: Website : https://eeco.or.th

Business hours: Monday-Friday, 8:30 a.m. - 4:30 p.m.

Source : EEC

Tel : +66 2033 8000