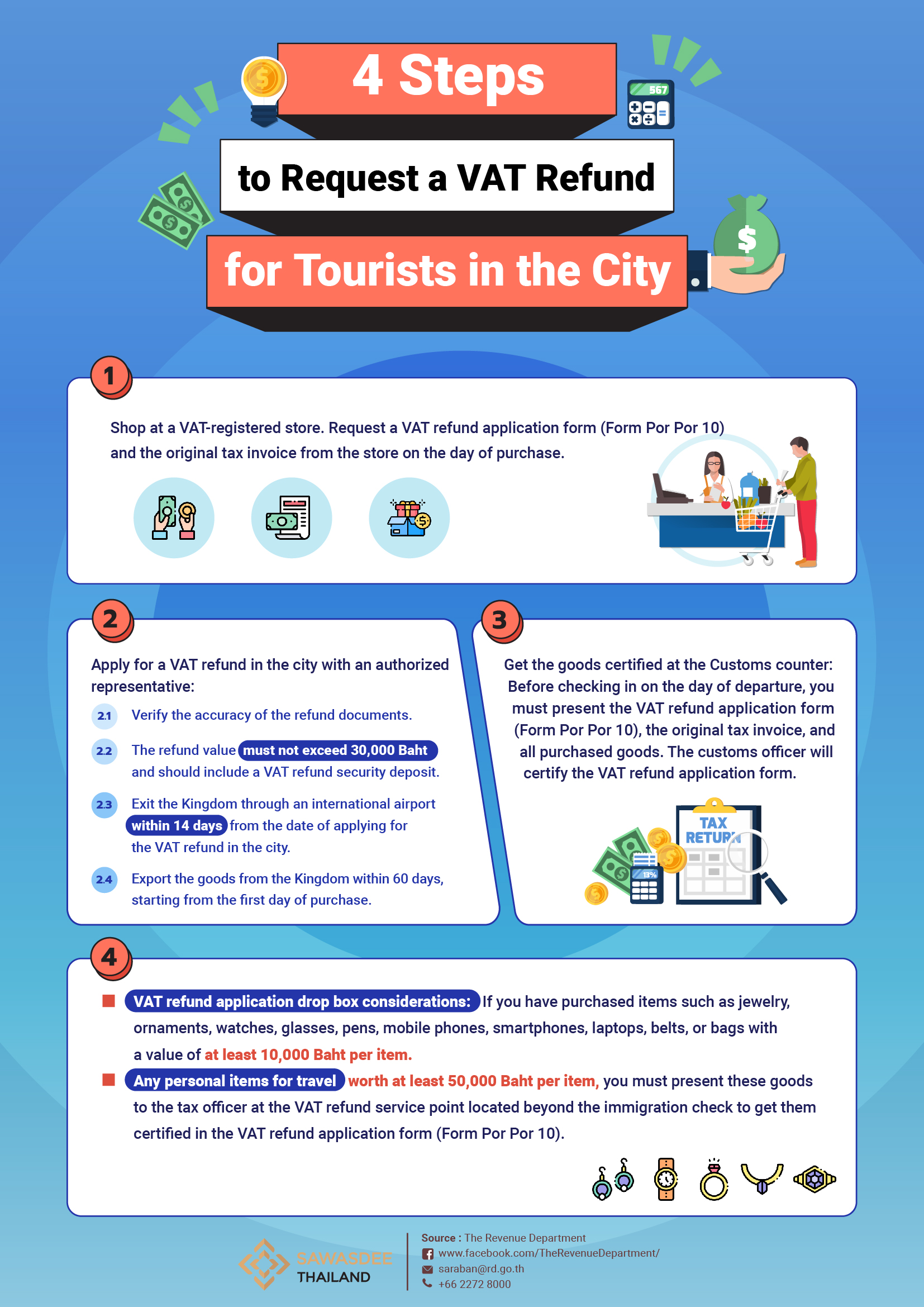

Did you know that tourists visiting Thailand can request a Value Added Tax (VAT) refund? There are 4 simple steps to request a VAT refund for tourists in the city:

1. Shop at a VAT-registered store: Make purchases from the same store on the same day for goods valued at no less than 2,000 Baht. Request a VAT refund application form (Form Por Por 10) and the original tax invoice from the store on the day of purchase. If you are buying consumable goods within the Kingdom, the products must be securely sealed, with the notice “No Consumption made Whilst in Thailand.”

2. Apply for a VAT refund in the city with an authorized representative:

2.1 Verify the accuracy of the refund documents.

2.2 The refund value must not exceed 30,000 Baht and should include a VAT refund security deposit.

2.3 Exit the Kingdom through an international airport within 14 days from the date of applying for the VAT refund in the city.

2.4 Export the goods from the Kingdom within 60 days, starting from the first day of purchase.

3. Get the goods certified at the Customs counter: Before checking in on the day of departure, you must present the VAT refund application form (Form Por Por 10), the original tax invoice, and all purchased goods worth at least 5,000 Baht per tourist and per trip to the customs officer at an international airport with a VAT refund application drop box installed. The customs officer will certify the VAT refund application form.

4. VAT refund application drop box considerations: If you have purchased items such as jewelry, ornaments, watches, glasses, pens, mobile phones, smartphones, laptops, belts, or bags with a value of at least 10,000 Baht per item, or any personal items for travel worth at least 50,000 Baht per item, you must present these goods to the tax officer at the VAT refund service point located beyond the immigration check to get them certified in the VAT refund application form (Form Por Por 10).