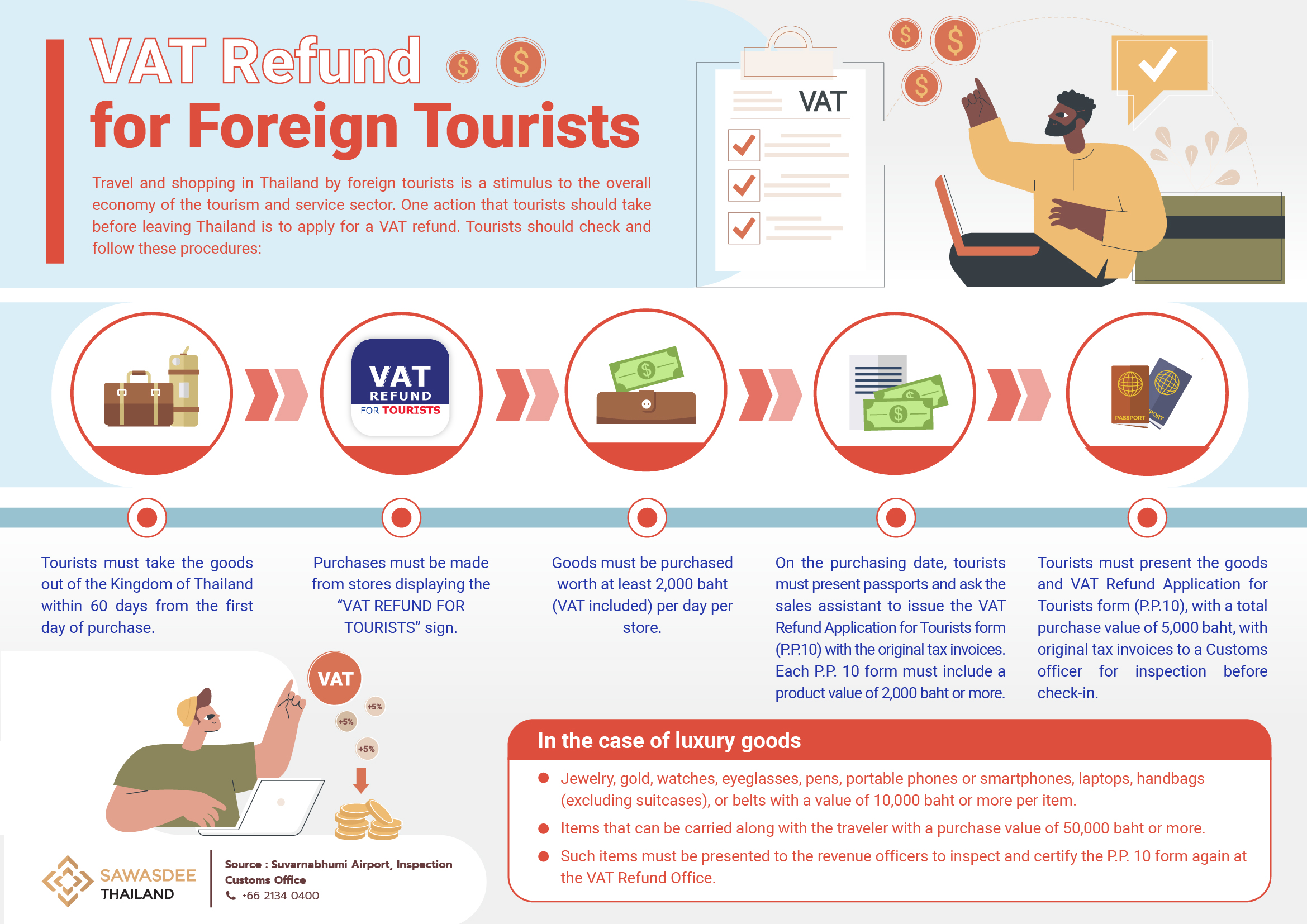

Traveling and shopping by foreign tourists in Thailand is a stimulus to the overall economy of the tourism and service sector. One action that tourists should take before leaving Thailand is to apply for a VAT refund. Tourists may check and follow these procedures:

- Tourists must take the goods out of the Kingdom of Thailand within 60 days from the first day of purchase;

- Purchases must be made from stores displaying the “VAT REFUND FOR TOURISTS” sign;

- The price of the goods must be at least 2,000 baht (VAT included) per day per store;

- On the purchasing date, tourists must present their passport and ask the sales assistant to issue the VAT Refund Application for Tourists form (PP.10) with the original tax invoices. Each PP.10 form must include a product value of 2,000 baht or more;

- Tourists must present the goods, the original tax invoices, and the VAT Refund Application for Tourists form (PP.10), showing a total purchase value of at least 5,000 baht, to a Customs officer for inspection before check-in;

- In the case of luxury goods, including jewelry, gold, watches, eyeglasses, pens, portable phones or smartphones, laptops, handbags (excluding suitcases), belts with a value of 10,000 baht or more per item, or items that can be carried along with the traveler with a purchase value of 50,000 baht or more, such items must be presented to the revenue officers to inspect and certify the PP. 10 form again at the VAT Refund Office, which is located in the departures area after the immigration checkpoints.

Information as of 19 March 2020