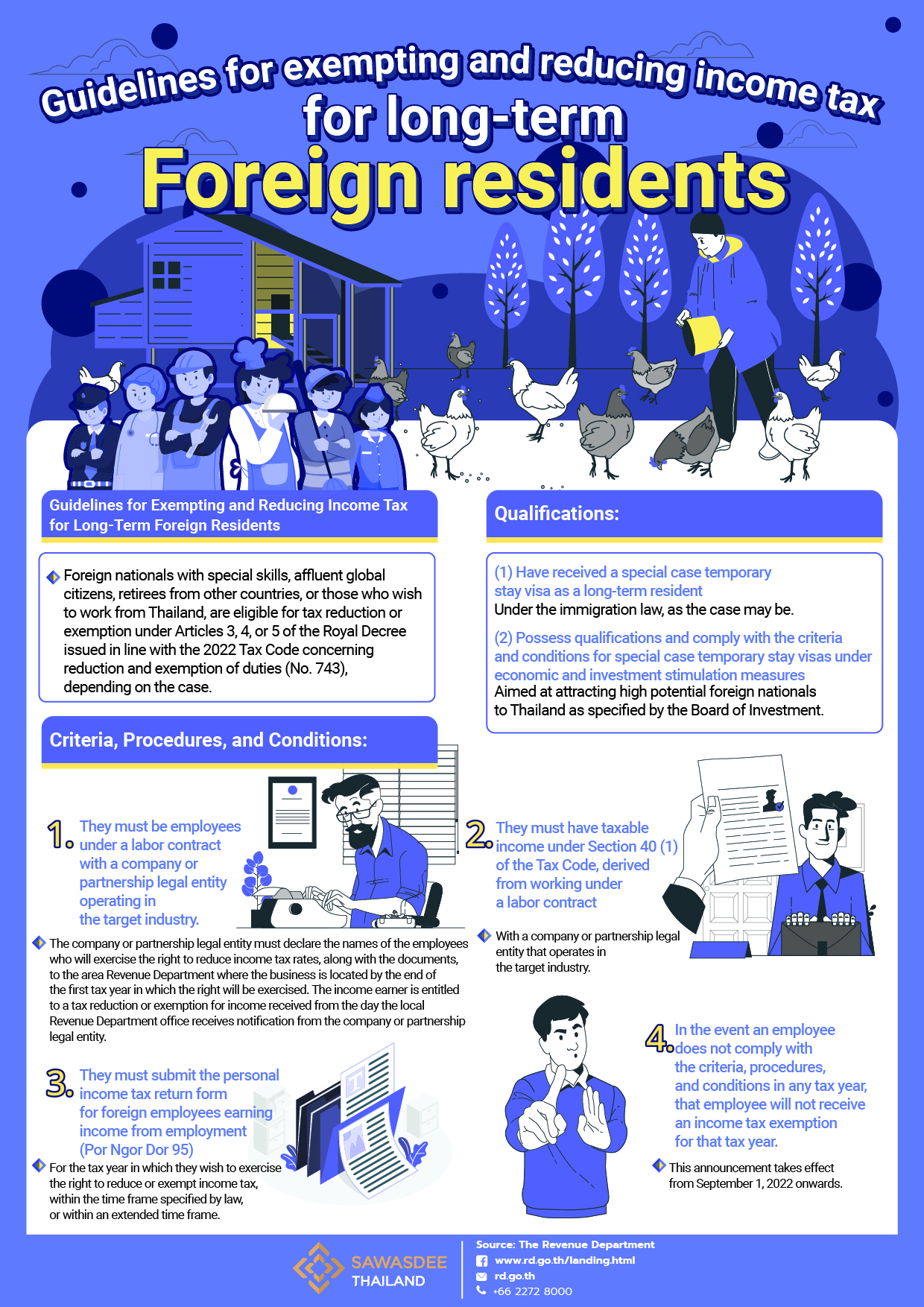

In response to the global crisis of COVID-19 that has had substantial impacts on economies worldwide, including Thailand, slowing economic growth, measures to reduce and exempt taxes have been introduced to stimulate the economy. These are designed to support and attract high potential foreign nationals to Thailand.

The Revenue Department has announced the criteria, methods, and conditions for reducing and exempting income tax for long-term foreign residents, as follows:

Foreign nationals with special skills, affluent global citizens, retirees from other countries, or those who wish to work from Thailand, are eligible for tax reduction or exemption under Articles 3, 4, or 5 of the Royal Decree issued in line with the 2022 Tax Code concerning reduction and exemption of duties (No. 743), depending on the case, and must meet the following qualifications:

- Have received a special case temporary stay visa as a long-term resident under the immigration law, as the case may be.

- Possess qualifications and comply with the criteria and conditions for special case temporary stay visas under economic and investment stimulation measures aimed at attracting high potential foreign nationals to Thailand as specified by the Board of Investment.

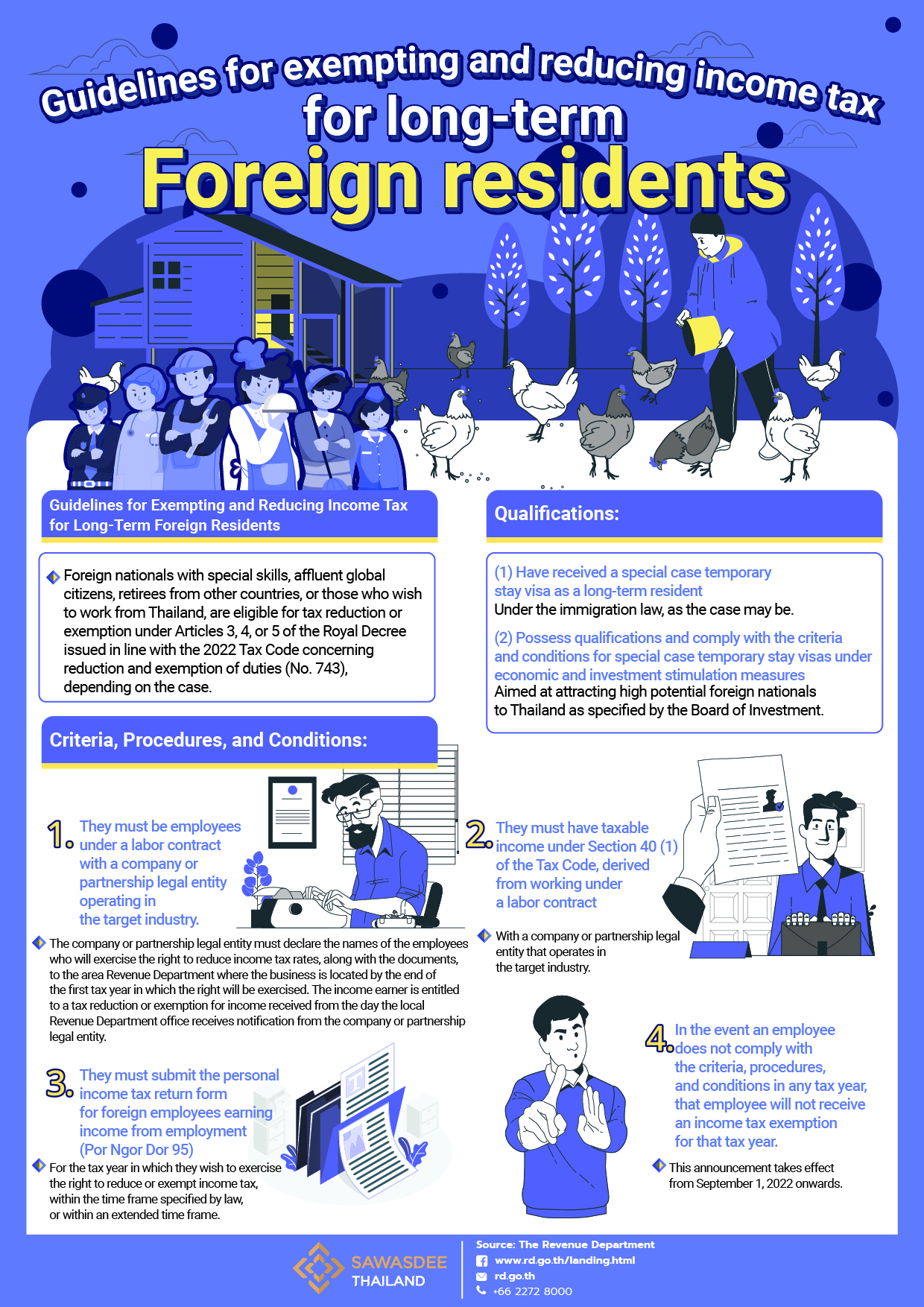

Foreign nationals who are eligible for income tax reduction or exemption under Articles 3 and 4 of the Royal Decree, in accordance with the 2022 Tax Code on the reduction and exemption of taxes (No. 743), must comply with the following criteria, procedures, and conditions:

- They must be employees under a labor contract with a company or partnership legal entity operating in the target industry. The company or partnership legal entity must declare the names of the employees who will exercise the right to reduce income tax rates, along with the documents, to the area Revenue Department where the business is located by the end of the first tax year in which the right will be exercised. The income earner is entitled to a tax reduction or exemption for income received from the day the local Revenue Department office receives notification from the company or partnership legal entity.

- They must have taxable income under Section 40 (1) of the Tax Code, derived from working under a labor contract with a company or partnership legal entity that operates in the target industry.

- They must submit the personal income tax return form for foreign employees earning income from employment (Por Ngor Dor 95) for the tax year in which they wish to exercise the right to reduce or exempt income tax, within the time frame specified by law, or within an extended time frame.

- In the event an employee does not comply with the criteria, procedures, and conditions in any tax year, that employee will not receive an income tax exemption for that tax year.

This announcement takes effect from September 1, 2022 onwards.

Data updated on September 28, 2022

Source: The Revenue Department, 90 Phaholyothin 7, Phayathai, Phayathai, Bangkok 10400

Tel. +66 2272 8000

For more information