The policy on developing industrial estates into Smart Industrial Estates (Smart IE) and Smart Industrial Zones (Smart IZ), with promotion of the application of technology and innovation.

The change will enhance the management of utilities and public utilities in industrial estates and facilitate business operators, which will result in increasing the competitiveness and driving the industrial economy of Thailand to grow strongly and sustainably.

In addition, they can take care of the environment by using clean energy and saving energy, as well as reducing greenhouse gas emissions, helping to prevent global warming. For those who are interested in investing in Thailand and wish to receive benefits, this guide will help them through the process of investing, whether new investors or existing investors who wish to expand their business with increased value and profit.

Intelligent systems consist of the following:

1. Smart Facilities is the use of technology or innovation to monitor, control, manage, and increase the efficiency of utility systems, such as the water supply system, wastewater treatment system, rainwater drainage system and flood protection system, industrial waste management system, solid waste and sewage, pollution or environmental quality monitoring system, and road system;

2. Smart IT is used to develop database systems and technology and information systems to facilitate the operations of entrepreneurs or related persons;

3. Smart Energy is the use of energy with continuously improving energy efficiency values, or using renewable energy to reduce greenhouse gas emissions to become a low-carbon industry;

4.Smart Economy means to create added value in the economy and manage resources efficiently by applying the principles of BCG (Bio Economy, Circular Economy, and Green Economy);

5. Smart Good Corporate Governance means to develop and supervise good corporate governance by communicating and disclosing information to third parties appropriately, equitably, and in a timely manner, through appropriate channels;

6. Smart Living means to develop facilities taking into account universal design principles to ensure that people to have good health and good quality of life, safety, and happiness;

7. Smart Workforce is the goal of improving knowledge and skills and creating an environment conducive to learning, as well as being open to creativity, innovation, and public participation, in order to raise and develop the quality of labor into the “4.0” level and raise the quality of the community with people’s participation.

Four types of business operations in industrial estates are as follows:

1. Industrial operations;

2. Service operations in the general industrial area;

3. Commercial operations in the free-trade zone;

4. Other businesses that are beneficial or related to the industrial estate.

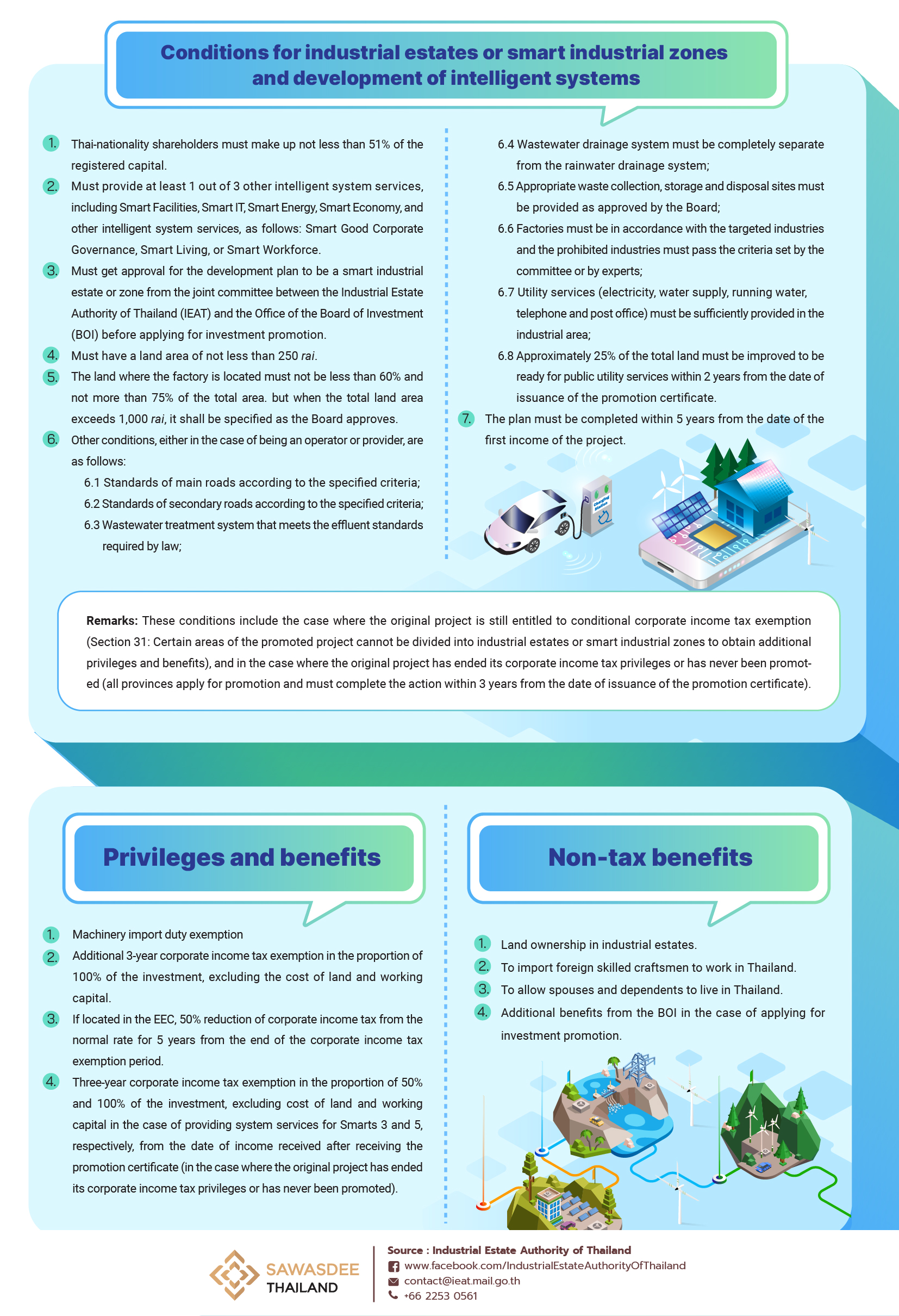

Conditions for industrial estates or smart industrial zones and development of intelligent systems

1. Must have Thai-nationality shareholders who hold not less than 51% of the registered capital;

2. Must provide at least 1 out of 3 other intelligent system services, including Smart Facilities, Smart IT, Smart Energy, and Smart Economy, and other intelligent system services, as follows: Smart Good Corporate Governance, Smart Living, or Smart Workforce;

3. Must get approval for the development plan to be a smart industrial estate or zone from the joint committee, composed of the Industrial Estate Authority of Thailand (IEAT) and the Office of the Board of Investment (BOI), before applying for investment promotion;

4. Must have a land area of not less than 250 rai;

5. The land where the factory is located must not be less than 60% and not more than 75% of the total area. However, if the total land area exceeds 1,000 rai, it shall be specified as the Board approves;

6. Other conditions, either in the case of being an operator or provider as follows:

6.1 Standards of main roads according to the specified criteria;

6.2 Standards of secondary roads according to the specified criteria;

6.3 Wastewater treatment system that meets the effluent standards required by law;

6.4 Wastewater drainage system must be completely separate from the rainwater drainage system;

6.5 Appropriate waste collection, storage and disposal sites must be provided as approved by the Board;

6.6 Factories must be in accordance with the targeted industries and the prohibited industries must pass the criteria set by the committee or experts;

6.7 Utility services (electricity, water supply, running water, telephone, and post office) must be sufficiently provided in the industrial area;

6.8 Approximately 25% of the total land must be improved to be ready for public utility services within 2 years from the date of issuance of the promotion certificate.

7. The plan must be completed within 5 years from the date of the first income of the project.

Remarks: These conditions includes the case where the original project is still entitled to conditional corporate income tax exemption (Section 31: Certain areas of the promoted project cannot be divided into industrial estates or smart industrial zones to obtain additional privileges and benefits), and in the case where the original project has ended its corporate income tax privileges or has never been promoted (all provinces apply for promotion and must complete the action within 3 years from the date of issuance of the promotion certificate).

Privileges and benefits

1. Machinery import duty exemption;

2. Additional 3-year corporate income tax exemption in the proportion of 100% of the investment, excluding the cost of land and working capital;

3. If located in the EEC, 50% reduction of corporate income tax from the normal rate for 5 years from the end of the corporate income tax exemption period;

4. Three-year corporate income tax exemption in the proportion of in the proportion of 50% and 100% of the investment, excluding cost of land and working capital in the case of providing system services for Smarts 3 and 5, respectively, from the date of income received after receiving the promotion certificate (in the case where the original project has ended its corporate income tax privileges or has never been promoted).

Non-tax benefits

1. Land ownership in industrial estates;

2. Allowed to import foreign skilled craftsmen to work in Thailand;

3. Allow spouses and dependents to live in Thailand;

4. Additional benefits from the BOI in the case of applying for investment promotion.

Permission for land use and business operations in industrial estates

1. To check with IEAT's criteria:

1.1 To consider the plot of land and the area according to the master plan. In case of change in area, it must adhere to the title deed with the criteria for considering the master plan / allocation plan.

- Application for permission to use land must refer to the master plan when considering granting permission;

In the case of a newly established industrial estate project, and if the allocation process has not yet been completed, when an entrepreneur submits an application for land use, the estate developer must clarify and confirm the completion of the development of the utility system, which must be completed before the entrepreneur notifies the commencement of business.

2. To consider the need for public utilities and various facilities, including the availability of supporting utilities such as central wastewater treatment systems, etc.;

3. To consider the types of business operations in accordance with the master plan, such as general industrial zones, and free trade zone;

4. To consider environmental pollution that may occur from business operations; for example, factories must have wastewater and air treatment systems;

5. To consider and ensure that doing business with the surrounding area does not affect other parties;

6. To consider the Company's business operation to suit the permitted area;

7. To consider the details of the operation and details about the production in accordance with the products and under the object details of the purpose of the company;

8. The operation under the guide will be from the officer checking all the documents, who will notify the result of the consideration to the applicant within 7 days from the date of completion of consideration.

List of supporting documents

1. ID card in the case of an individual;

2. Copy of house registration In the case of making a legal transaction with IEAT as an individual;

3. Certificate of juristic person with details of business objectives (not older than 6 months) and certified true copy by the authorized director with the Company's seal according to the certificate or the authorized person according to the power of attorney);

4. List of shareholders (Bor.Or.Jor.5) not older than 6 months, with certified true copy by the authorized director with the Company's seal;

5. Master plan (including specifying the plot of land intended for use);

6. Copy of the land title deed or the document showing the right to use the land, such as purchase and sale agreement, lease agreement, etc.;

8. Environmental Impact Assessment Report (EIA / EHIA) (if applicable);

9. Documents related to the production process;

10. Other additional important documents as specified by the officer.

Application for investment promotion and permission to use land for industrial estates

1. Head office of Industrial Estate Authority of Thailand (IEAT) in Bangkok or Industrial Estate Office where the factory is located and online channel: https://epp-ent.ieat.go.th/epp/ (Permission and Privilege or e-PP);

2. Office of the Board of Investment

Source : Thailand Board of Investment 555

Tel : +66 2553 8111