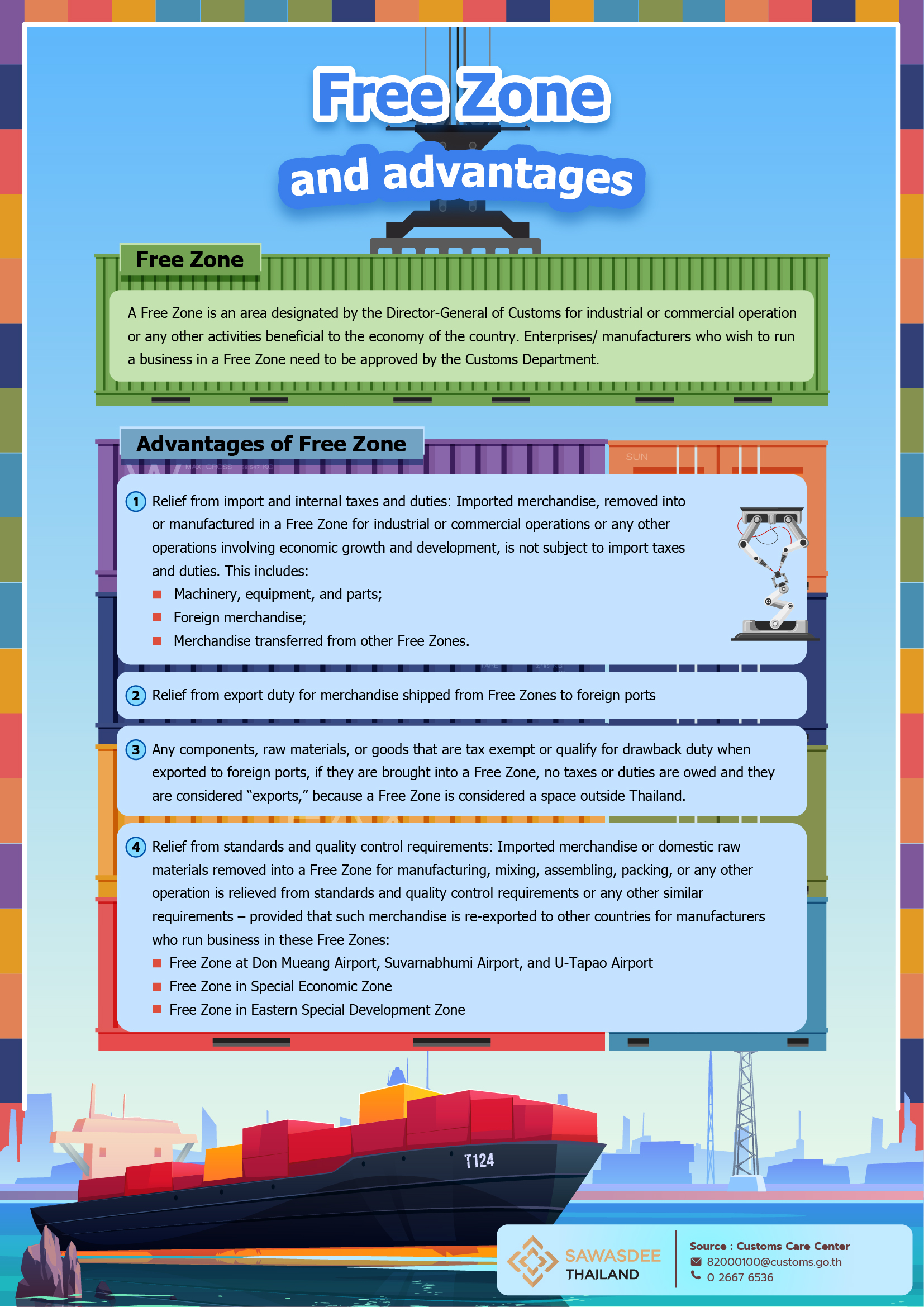

A Free Zone is an area designated by the Director-General of Customs for industrial or commercial operation or any other activities beneficial to the economy of the country. Enterprises and manufacturers who wish to run their business in a Free Zone need to obtain approval from the Customs Department.

Advantages of a Free Zone

1.Relief from import and internal taxes and duties: Imported merchandise, removed into or manufactured in a Free Zone for industrial or commercial operations or any other operations involving economic growth and development, is not subject to import taxes and duties. This includes the following:

- Machinery, equipment, and parts;

- Foreign merchandise;

- Merchandise transferred from other Free Zones.

2. Relief from export duty for merchandise shipped from Free Zones to foreign ports;

3. Any components or raw materials or goods that are tax exempt or eligible for drawback duty when exported to foreign port, if they are brought into a Free Zone, no taxes or duties are owed, and they are considered exports, because a Free Zone is considered to be outside Thailand.

4. Relief from standards/ quality control requirements: Imported merchandise or domestic raw materials moved into a Free Zone for manufacturing, mixing, assembling, packing, or any other operations is relieved from standards/ quality control requirements or any other similar requirements – provided that such merchandise is re-exported to other countries for manufacturers who run businesses in the following Free Zones:

- Free Zone at Don Mueang Airport, Suvarnabhumi Airport, and U-Tapao Airport;

- Free Zone in the Special Economic Zone;

- Free Zone in the Eastern Special Development Zone.

Data updated on July 23, 2018

Source: Free Zone Establishment Department, Customs Department

Tel. +66 2667 6536